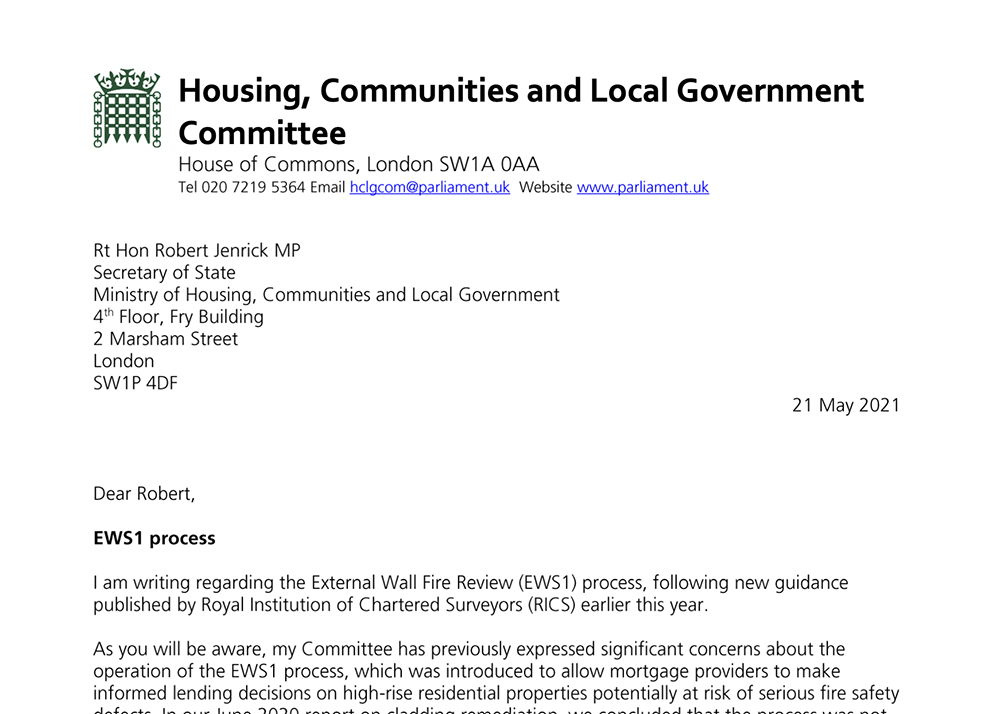

HCLGC Chair Clive Betts MP writes to MHCLG Minister Robert Jenrick re ongoing EWS1 difficulties

With the Royal Institution for Chartered Surveyors (RICS) issuing new EWS1 criteria in March, the broad hope was that we might start to see the EWS1 debacle begin to be resolved, at least for some properties.

When we looked at the new RICS guidance recently, however, we did highlight some remaining concerns.

Where the guidance (and indeed the whole EWS1 scheme) is not a part of legislation nor any building regulations lenders could simply choose to ignore it, continue insisting on EWS1 surveys, and continue to refuse to lend on properties without a passing EWS1 certificate.

Sadly, that does seem to have been the case, at least according to a letter sent by Clive Betts MP, Chair of the Housing, Communities and Local Government Committee (HCLGC) to Housing Minister Robert Jenrick MP.

In the letter, Mr Betts references to the new RICS guidance as he goes on to highlight cases where leaseholders have reported that mortgages have been refused without a satisfactory EWS1 form, despite their properties being in buildings that appear to be exempted from EWS1 by the new RICS criterion.

AliDeck has been at the forefront of understanding the ramifications of EWS1 and we raised the possibility of lenders simply ignoring the RICS criteria when we looked at EWS1 v2 in March this year. As EWS1 is not a statutory, Government-led initiative, lenders cannot be compelled to lend money on buildings that they consider to be a high risk for costly remedial works. This fear very much seems to have been realised.

The only certain way to resolve fire safety issues is to remove all combustible materials and replace with non-combustible alternatives. Ultimately, fully remediating a building is the surest route to homeowners being able to sell or mortgage their properties. Without Government making a firm intervention to bring this debacle to an end, it can only drag on for many more months and even years to come.